Manatee County Property Appraiser: Find Info & More!

Are you navigating the complexities of property ownership in Manatee County, Florida? Understanding your property taxes and the resources available to you is crucial, and this comprehensive guide is designed to provide you with clarity and the tools you need.

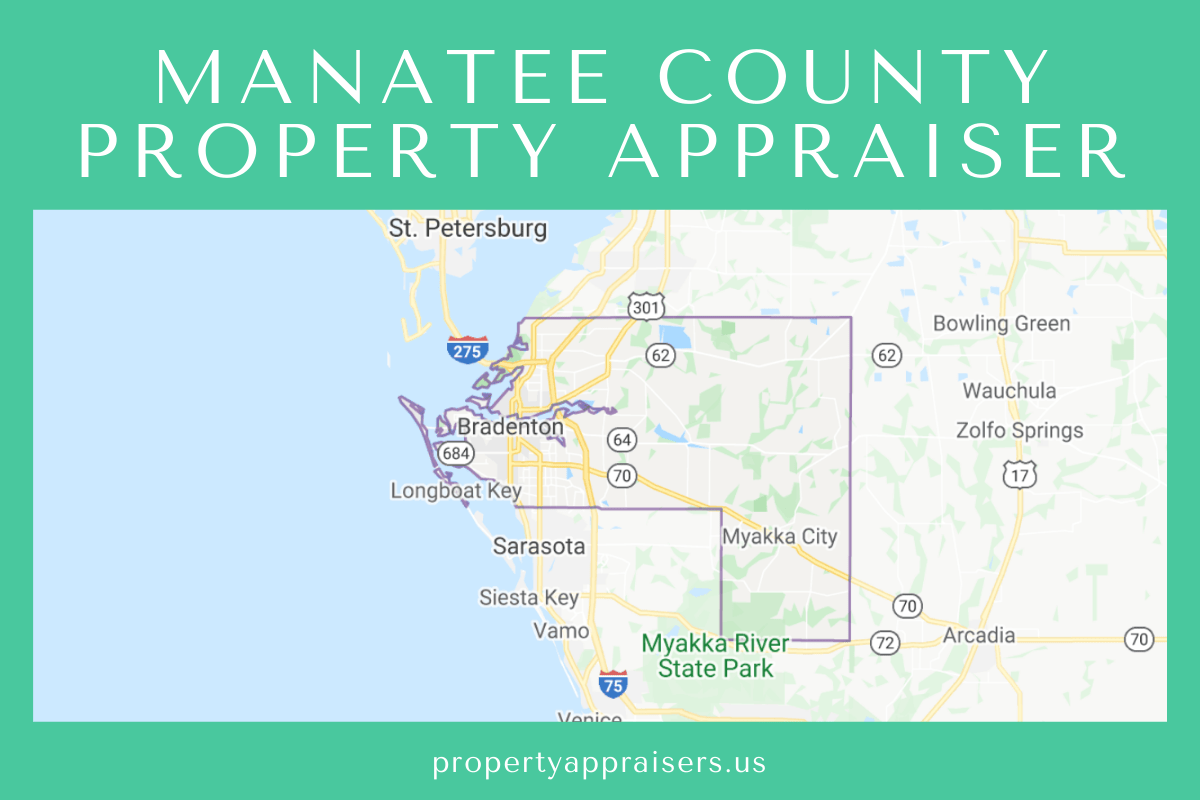

Manatee County, a vibrant region on Florida's Gulf Coast, presents unique opportunities and responsibilities for property owners. From beachfront residences to commercial enterprises, understanding the local property tax landscape is essential for financial planning and compliance. The Manatee County Property Appraiser's Office, led by Charlie, is your primary resource for all things related to property assessment, exemptions, and tax information. This article will delve into the key aspects of this office, providing you with the information and tools you need to effectively manage your property investments.

This article will act as your compass, providing detailed insights into property taxes, the roles of different agencies, and the resources available to you. The aim is to empower you with knowledge, enabling you to make informed decisions and navigate the complexities of property ownership in Manatee County with confidence. Whether you are a long-time resident or a new property owner, the information provided here will equip you to understand and manage your property-related responsibilities effectively.

- Unveiling Kelly Baltazar Age Family Controversies The Full Story

- Paige Spiranac Nude Photo Leak Its Lasting Impact Latest News

To navigate the world of property taxes, it's crucial to understand the core components. The Property Appraiser's Office plays a vital role in the process. Their responsibilities include assessing the value of both real and personal property, granting exemptions, and updating the tax roll to reflect ownership and address changes. They are also responsible for making other necessary corrections to the tax roll.

If you need to contact The Office of Charlie for any questions or require assistance you can find their contact details here to get further information.

- Daniel Radcliffe Fatherhood Family Career What You Need To Know

- From Ace Of Cakes To La The Charm City Cakes Journey

The following table summarizes essential information about The Manatee County Property Appraiser's Office, which offers a range of services and resources for property owners.

| Category | Details |

|---|---|

| Office Name | Manatee County Property Appraiser's Office |

| Primary Function | Assessing the value of real and personal property, granting exemptions, and maintaining the tax roll. |

| Key Services | Property information search, tax bill payments, exemption applications, and more. |

| Contact Information | Contact the office of Charlie, your property appraiser, for questions or assistance. |

| Location | Manatee County Administration Building, 1112 Manatee Ave West, Bradenton, FL 34205 |

| Online Resources |

|

| Advanced Search Options | Use advanced search options to filter by owner, parcel, property type, land use, and more. |

| Property Tax Information | Learn about real estate, tangible personal, and exemption taxes, payments, certificates, deferrals, and more. |

| Additional Notes | The office also administers various property tax exemptions, including the homestead exemption. The property appraiser's office is part of the manatee county government and serves all property owners in the |

| Reference Website | Manatee County Property Appraiser's Official Website |

The Manatee County Property Appraiser's Office is not the sole player in the property tax system. In Florida, property taxes are handled by two key agencies. The Property Appraiser's Office is responsible for assessing the value of properties. This valuation forms the basis for the taxes. The other major player is the Tax Collector's Office. The Tax Collector's Office, which is a separate entity, is responsible for collecting those taxes. It's essential to understand this division of responsibility for effective communication and action.

In the spirit of transparency and public access, it's essential to know that email addresses are public records. If you are concerned about the release of your email address in response to a public records request, you should not send electronic mail to the Manatee County Property Appraiser's Office.

Understanding the various aspects of property taxes can often feel daunting. But that does not have to be the case. One crucial aspect of property taxes is the application of land use codes (LUC). The Property Appraiser assigns a land use code (LUC) to every property in Manatee County. These codes categorize properties based on their intended use, providing a standardized system for valuation and assessment. For instance, "County" is assigned to all parcels that have vertical structures.

Another significant program in Manatee County is the Property Assessed Clean Energy (PACE) program. This program operates in the unincorporated areas of Manatee County. PACE provides a financing mechanism for property owners to make qualifying improvements to their businesses or homes. These improvements can include energy efficiency upgrades, renewable energy installations, and measures to improve wind resistance. PACE offers a pathway for property owners to invest in their properties while simultaneously promoting sustainable practices.

For those seeking specific information, the office provides several online services. You can use advanced search options to filter by owner, parcel, property type, land use, and more. Additionally, the website offers access to tax roll data for current and previous years. You can find a wide array of resources, exemptions, and online services to assist with property tax management.

Discount periods are available for annual payments. Check the official website or contact the Tax Collector's Office for information on discount periods, payment options, and installment plans to find the best payment strategy for your situation.

The Property Appraiser's Office is responsible for appraising all real and personal property within Manatee County, Florida. They also administer various property tax exemptions, including the homestead exemption, which can significantly reduce the taxable value of your property.

The Manatee County Property Appraisers Office is committed to serving property owners, which means they provide tools and resources to help them understand the system. You can view an interactive map with parcel details, ownership type, and land use code from the property appraiser's office.

The county also provides a "Property Owner Bill of Rights", ensuring transparency and fairness in the property tax process.

For further information, the Manatee Board of County Commissioners has approved an exemption of $25,000 from county millage for qualified seniors. The municipalities of Anna Maria, Longboat Key, Bradenton Beach, and Holmes Beach have also adopted an exemption from city millage on $25,000 of assessed value in addition to their standard homestead exemption.

The Property Appraiser's Office is part of the Manatee County government and serves all property owners in the County. Understanding the role of the Property Appraiser helps in navigating the tax system. The role of the property appraiser is to establish the assessed value of real and personal property, grant exemptions, update the tax roll with ownership and address changes, and perform other tax roll corrections as needed.

If you have questions or concerns regarding your property assessment or exemptions, please do not hesitate to contact our office. For more information, forms, reports and property assessments visit the website.

It is important to remember that this information is believed to be correct but is subject to change and is not warranted. Always refer to the official website of the Manatee County Property Appraiser for the most up-to-date and accurate information.

To summarize, the Manatee County Property Appraiser's Office is a critical resource for property owners in Florida. By understanding the services provided, and utilizing the available online tools and resources, property owners can effectively navigate the property tax system and ensure compliance with local regulations. Remember to visit the official website for the most current information and to contact the office directly for any specific questions.

Detail Author:

- Name : Carson Harris

- Username : sarah74

- Email : barton.stroman@yahoo.com

- Birthdate : 1976-03-29

- Address : 6444 Gerald Roads New Dewaynetown, MN 34889-7164

- Phone : 952-662-6147

- Company : Mante Ltd

- Job : Aircraft Launch and Recovery Officer

- Bio : Rerum cum fugiat nihil corporis et iste. Porro esse est vitae dicta harum. Qui vitae numquam sed sed sed. Adipisci tempore et eaque cum.

Socials

facebook:

- url : https://facebook.com/dave_nolan

- username : dave_nolan

- bio : Ducimus dolor qui aperiam repellat et minima.

- followers : 2930

- following : 521

instagram:

- url : https://instagram.com/dave.nolan

- username : dave.nolan

- bio : Deleniti qui architecto velit. Non placeat eum id.

- followers : 3307

- following : 2521

linkedin:

- url : https://linkedin.com/in/dave.nolan

- username : dave.nolan

- bio : Dignissimos unde rerum ut eaque.

- followers : 5193

- following : 255

twitter:

- url : https://twitter.com/davenolan

- username : davenolan

- bio : Enim officia sint quibusdam veniam saepe. Quis aliquid et est non impedit. Velit pariatur quam placeat sequi omnis illum fugiat.

- followers : 560

- following : 2157

tiktok:

- url : https://tiktok.com/@dnolan

- username : dnolan

- bio : Eligendi impedit illo et repellendus facilis sunt.

- followers : 4586

- following : 124