VTI Vs. VOO: Which Vanguard ETF Is Right For You?

Are you looking for a straightforward way to invest in the U.S. stock market? Choosing between the Vanguard Total Stock Market ETF (VTI) and the Vanguard S&P 500 ETF (VOO) could be the first step to achieving your financial goals. These two popular exchange-traded funds (ETFs) offer broad exposure to the American market, but they have distinct characteristics that could impact your investment strategy.

Both VOO and VTI are popular choices for passive investors seeking broad market exposure. They share similarities, particularly in their low expense ratios, which make them attractive for long-term investing. However, subtle differences in their structure and investment approach can lead to variations in performance. The historical performance of these funds is a key consideration, as is understanding their specific investment strategies. For instance, comparing the price-to-earnings (P/E) ratios can provide insights into valuation differences. While the two funds largely overlap in their holdings, these nuances are critical for making an informed investment decision. The choice between VTI and VOO ultimately depends on an investor's individual risk tolerance and the time horizon they are planning for.

Heres a comparative look at VTI and VOO, providing a clear understanding of how these two ETFs stack up against each other.

- Explore Aishah Sofey Nudes Leaked Content Free

- Kaitlyn Krems Onlyfans Leaked Nudes Porn Videos Watch Now

| Feature | Vanguard Total Stock Market ETF (VTI) | Vanguard S&P 500 ETF (VOO) |

|---|---|---|

| Index Tracked | CRSP US Total Market Index | S&P 500 Index |

| Number of Holdings | Approximately 3,800 stocks | Approximately 500 stocks |

| Market Coverage | Represents nearly the entire U.S. stock market, including large, mid, and small-cap companies | Focuses on the 500 largest U.S. companies |

| Expense Ratio | Very Low (typically around 0.03%) | Very Low (typically around 0.03%) |

| Inception Date | May 2001 | September 2010 |

| Investment Approach | Offers a diversified portfolio that includes a wide range of U.S. companies | Targets the largest and most established U.S. companies |

| Potential Advantages | Higher diversification, potentially capturing higher returns from small-cap stocks (size premium) | Simplicity, focus on established companies, widely recognized index |

| Potential Disadvantages | May have slightly higher volatility due to small-cap exposure | Less diversification, potential to miss out on growth from smaller companies |

| Historical Performance (10-Year Average) | Generally similar, with slight variations year to year | Generally similar, with slight variations year to year |

| Risk Tolerance | Suitable for investors with a moderate to high risk tolerance and a long-term investment horizon | Suitable for investors with a moderate risk tolerance and a long-term investment horizon |

For those looking to delve deeper into the performance of these ETFs, resources like Vanguard's official website provide comprehensive data, analysis, and insights.

The Vanguard Total Stock Market ETF (VTI) and the Vanguard S&P 500 ETF (VOO) are two of the most popular Vanguard funds, and they provide broad exposure to the U.S. stock market. Both ETFs are favored by passive investors due to their low expense ratios. However, their investment approaches, and thus their compositions, differ significantly.

VTI tracks the CRSP US Total Market Index, which includes virtually all publicly traded companies in the United States, irrespective of their size. This comprehensive approach results in a highly diversified portfolio. In contrast, VOO tracks the S&P 500 Index, comprising the 500 largest U.S. companies. This index is chosen by an S&P committee, focusing on established, large-cap companies. This difference in index composition is the primary driver of the differences between VTI and VOO.

- Mia Yilins Personality Tests Illusions Unveiling The Truth

- Lizzy Wurst Leaks Explore The Buzz Trending Videos Now

One of the key differences lies in their diversification. VTI holds a significantly larger number of stocks than VOO. While VOO focuses on approximately 500 of the largest U.S. companies, VTI invests in around 3,800 stocks, covering a wider range of market capitalization, including small-cap and mid-cap companies. This broader diversification can make VTI less volatile than VOO, though it may also mean slightly lower returns in exceptionally strong markets for large-cap stocks.

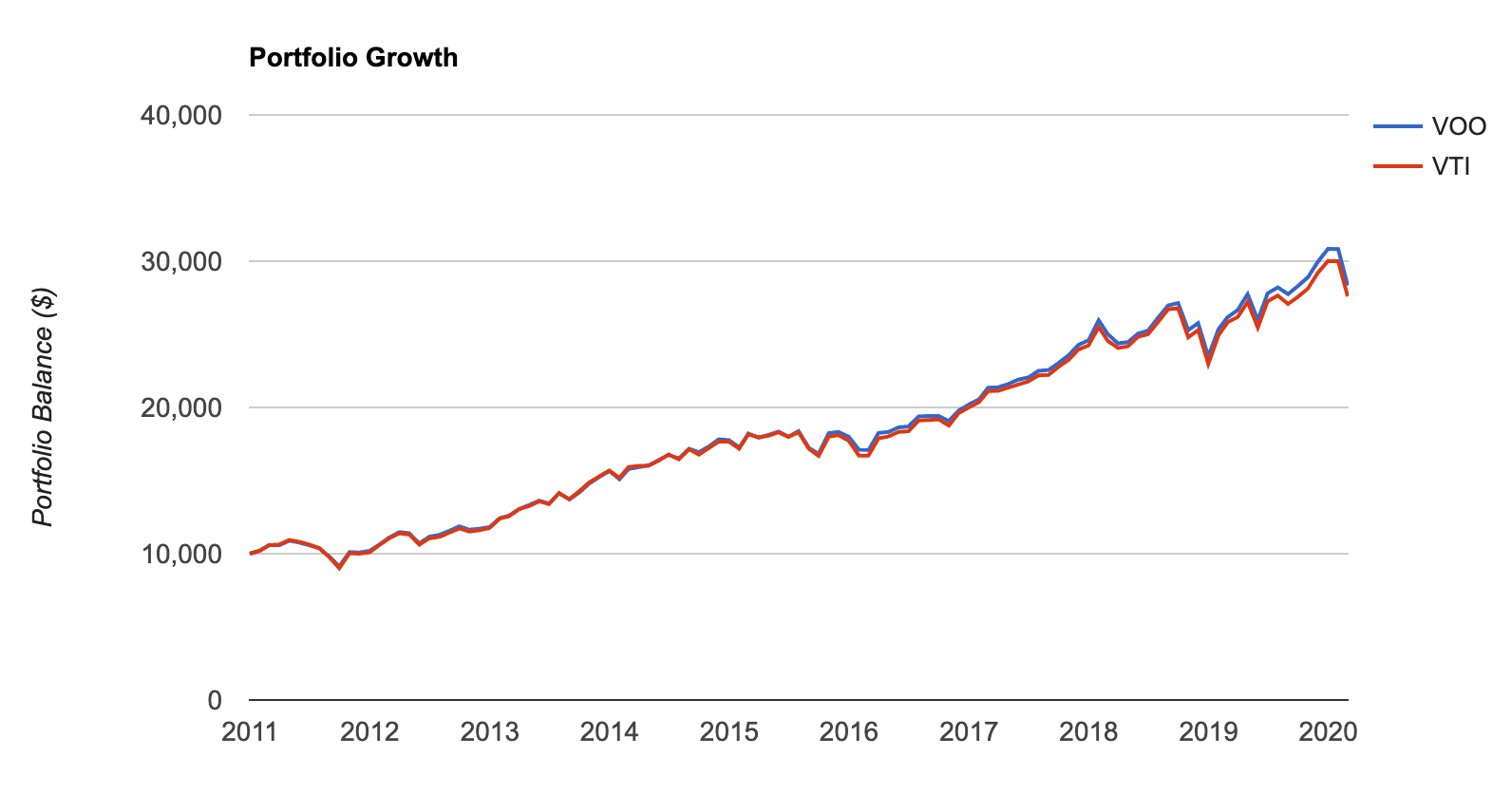

Historical performance provides valuable context when comparing VTI and VOO. While both ETFs have similar low expense ratios, their returns can vary slightly over time due to their different holdings. Over the past 10 years, VOO has slightly outperformed VTI, but this is not a consistent trend. It is essential to consider longer-term trends and the current market conditions when assessing their performance. Moreover, past performance does not guarantee future results, and each fund's suitability depends on an investors specific goals, risk tolerance, and time horizon.

The expense ratios of both VTI and VOO are very similar, typically around 0.03%. This low cost is a significant advantage for investors, as it allows them to retain a more considerable portion of their returns. When comparing these two ETFs, the expense ratio should not be the primary factor for decision-making, as the difference is negligible. The focus should be on the underlying holdings, diversification benefits, and alignment with your overall investment strategy.

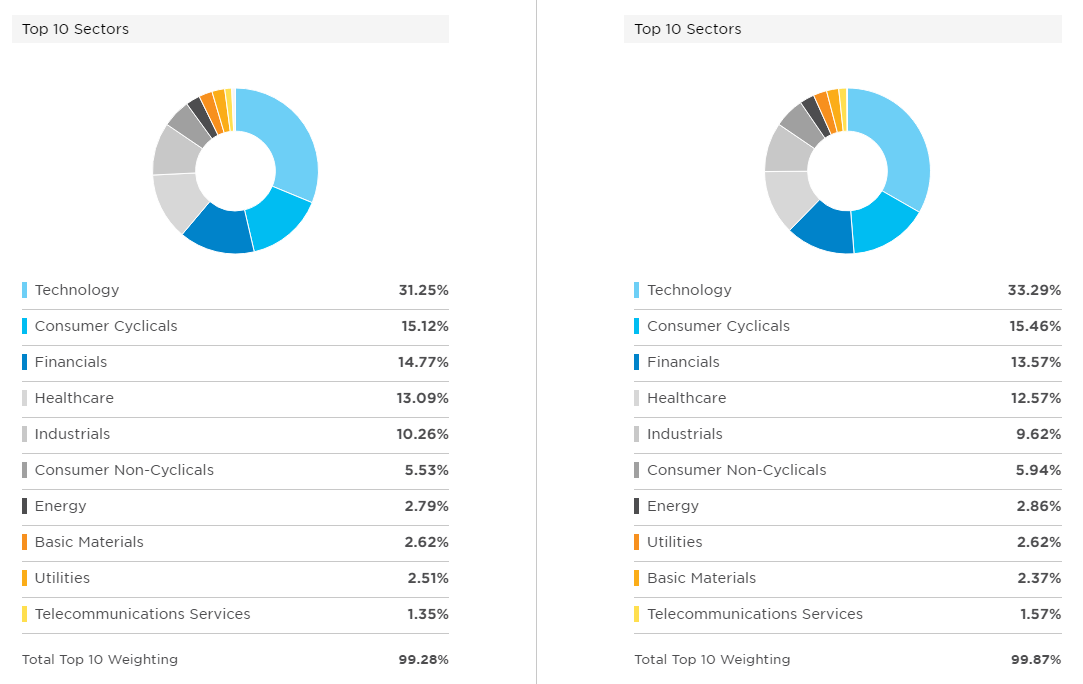

Another crucial aspect to consider is the sector exposure of each ETF. VOO's focus on the S&P 500 means it has higher exposure to specific sectors, such as technology and healthcare, which are prominent in the index. VTI, due to its broader market coverage, offers a more balanced sector allocation, including real estate, financials, and materials, which may be less represented in VOO. This difference in sector allocation is a key factor influencing the risk and potential return of each fund. It is essential to evaluate how well the fund's sector exposures align with your overall investment preferences.

When considering the differences between VTI and VOO, its essential to acknowledge the size risk factor premium. Historically, smaller companies (small-cap stocks) have outperformed large companies (large-cap stocks) over the long term, although they are also subject to greater volatility. VTI's broader coverage includes a greater percentage of small-cap stocks, potentially allowing investors to benefit from this size premium. VOO, being concentrated in large-cap stocks, does not capture this potential upside as extensively. This is a crucial element when considering the potential long-term gains of both ETFs.

In practical terms, the choice between VTI and VOO is a decision about diversification and the inclusion of small-cap companies. VTI offers wider diversification and includes small-cap stocks, which may have greater growth potential over time. VOO focuses exclusively on large-cap stocks and is, therefore, less diversified but may be more straightforward for some investors to understand.

The choice between VTI and VOO also involves understanding how these ETFs fit into your overall investment strategy. VTI's comprehensive coverage makes it a suitable core holding for a diversified portfolio. Investors might choose VTI if they want a single fund representing the entire U.S. stock market. VOO, on the other hand, can serve as the foundation for a portfolio, or can be used in conjunction with other investments to gain more specific market exposures. The decision depends on whether you prefer a total market approach or a strategy centered around established large-cap companies. The goal is to create an investment plan that aligns with your individual goals and objectives.

The Vanguard Total Stock Market ETF (VTI) came to life in May 2001, and the Vanguard S&P 500 ETF (VOO) followed in September 2010. This difference in their inception dates is one aspect that affects the historical data available for each. As with any investment, the longer the track record, the better you can analyze the long-term performance. While VTI has a longer history, both funds have proven themselves as solid options for U.S. market exposure.

In conclusion, both VTI and VOO are excellent options for passive investing, providing broad exposure to the U.S. stock market with low expense ratios. VTI's broader diversification and inclusion of small-cap companies make it a strong choice for investors seeking comprehensive market coverage, while VOO offers a focused approach to the largest U.S. companies. The ultimate decision depends on your personal investment preferences, your risk tolerance, and your overall financial strategy. By understanding the differences and similarities between these two ETFs, you can make an informed choice that aligns with your goals and helps you achieve your financial objectives. Assess your individual needs, and consider how the funds complement each other, to find the best fit for your portfolio.

Detail Author:

- Name : Brent Kiehn

- Username : whowell

- Email : ernestine98@gmail.com

- Birthdate : 2005-07-20

- Address : 465 Labadie Centers Suite 442 South Murielview, WY 93036-5909

- Phone : 520.443.6357

- Company : VonRueden and Sons

- Job : Management Analyst

- Bio : Molestias quis corporis quia ullam quia reprehenderit. Sint sit qui libero aut. Tempora ducimus perferendis voluptatum. Rerum nihil ut pariatur voluptas animi et.

Socials

twitter:

- url : https://twitter.com/lou8857

- username : lou8857

- bio : Odio aspernatur cupiditate et. Quis deserunt quam et porro optio commodi corporis doloribus. Aut sit incidunt id eveniet dolore voluptatibus porro.

- followers : 813

- following : 1592

tiktok:

- url : https://tiktok.com/@lhermann

- username : lhermann

- bio : Quaerat et ut delectus ut. Quaerat et dolor sunt.

- followers : 1571

- following : 2852

linkedin:

- url : https://linkedin.com/in/lou.hermann

- username : lou.hermann

- bio : In nulla ut eligendi perspiciatis.

- followers : 5461

- following : 2333

facebook:

- url : https://facebook.com/lou_hermann

- username : lou_hermann

- bio : Commodi quod corporis perspiciatis consequuntur et.

- followers : 4536

- following : 2572

instagram:

- url : https://instagram.com/louhermann

- username : louhermann

- bio : Et debitis illo dolor ut at voluptatibus. Officia consequatur vero ipsum.

- followers : 2772

- following : 2855